In today's increasingly digital world, the use of paper receipts is being challenged by the emergence of digital receipts. As shoppers and businesses embrace new technologies, the debate over which type of receipt is better has gained momentum. In this article, we will explore the pros and cons of digital and paper receipts, offering insights on when and where each type may be more appropriate.

Digital receipts vs. paper receipts. Which is better?

Introduction :

Receipts serve as proof of purchase and are essential for record-keeping, expense tracking, and returns. Traditionally, paper receipts have been the norm, but with digital transactions and the push for sustainability, digital receipts have gained popularity. Let's delve into the advantages and drawbacks of both options to help you make an informed decision.

The rise of digital receipts

Digital receipts have seen a significant surge in recent years, fueled by the increasing prevalence of e-commerce, mobile payments, and digital wallets. Instead of receiving a physical piece of paper, digital receipts are sent electronically to the customer's email address or stored within a mobile app.

Advantages of digital receipts

Convenience and accessibility:

One of the primary advantages of digital receipts is the convenience they offer. With digital receipts, there is no need to worry about losing or misplacing paper receipts. They can be easily accessed, searched, and retrieved from email or a dedicated app, making them readily available whenever needed.

Environmentally friendly:

Digital receipts are a greener alternative to paper receipts. By reducing the consumption of paper and ink, digital receipts contribute to a more sustainable environment. This is a compelling reason to opt for digital receipts for eco-conscious individuals and businesses.

Organizational benefits:

Digital receipts can help individuals and businesses stay organized. They can be easily categorized, tagged, and stored electronically, eliminating the need for physical filing systems. This digital organization can simplify expense tracking, budgeting, and tax preparation processes. They benefit every consumer to be able to manage their finances.

Limitations of paper receipts

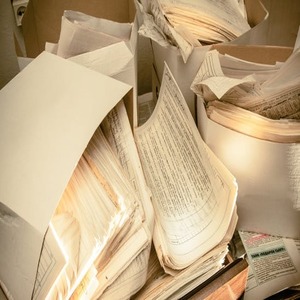

Clutter and storage issues:

Accumulating paper receipts can quickly lead to clutter and disorganization. Physical receipts take up space, require manual filing, and can be easily lost or damaged. Managing large volumes of paper receipts can become a cumbersome task, especially for individuals or businesses with high transaction volumes.

Environmental impact:

Paper receipts have a notable environmental footprint. The production of paper requires resources such as trees, water, and energy. Additionally, the disposal of paper receipts contributes to waste and requires appropriate recycling practices to minimize environmental harm.

Inefficiency in record-keeping:

Paper receipts are prone to fading, tearing, or getting misplaced. Retrieving specific information from a pile of paper receipts can be time-consuming and frustrating. In contrast, digital receipts allow for easy searching and filtering, enabling efficient record-keeping and data analysis. You can also read more financial information from our blog section.

Choosing the right receipt format

When deciding between digital and paper receipts, various factors come into play, depending on whether you are an individual or a business. For individuals, consider your personal preferences, lifestyle, and accessibility to technology. If you are tech-savvy, value convenience, and prioritize environmental sustainability, digital receipts, just like KENAF, maybe the better choice for you. However, if you prefer the tangibility of paper, have specific compliance requirements, or face limited access to technology, paper receipts might still be the preferred option. Businesses need to consider their customer base, legal obligations, and operational efficiency. Offering both digital and paper receipt options can cater to a broader range of customer preferences. However, transitioning to digital receipts can streamline administrative tasks, reduce costs, and align with sustainability initiatives.

Conclusion

In the ongoing debate between digital receipts and paper receipts, there is no definitive answer as to which is better. Both formats have their advantages and drawbacks, and the choice ultimately depends on individual preferences, accessibility to technology, and specific business requirements. The rise of digital transactions and the push for sustainability have given digital receipts an edge, but paper receipts still hold relevance in certain situations. As technology continues to evolve, it is likely that digital receipts will become increasingly prevalent, but their coexistence with paper receipts is likely to persist for the foreseeable future.

Frequently Asked Questions (FAQs)

Digital receipts are generally considered legally valid, especially in jurisdictions that recognize electronic records and digital signatures. However, it is essential to ensure compliance with specific laws and regulations that govern electronic transactions in your region.

In most cases, digital receipts are accepted for tax purposes. However, it is advisable to consult with a tax professional or refer to the tax guidelines of your jurisdiction to understand the specific requirements and record-keeping obligations.

While many retailers accept digital receipts for returns, some may still require a paper receipt as proof of purchase. It is recommended to check the return policy of the specific retailer before making a return.

To ensure the security of your digital receipts, choose reputable providers or apps that prioritize data encryption and protection. It is also advisable to use strong passwords, enable two-factor authentication when available, and regularly update your devices and software for enhanced security.

Switching from paper receipts to digital receipts for your business can offer various benefits, such as cost savings, efficiency gains, and reduced environmental impact. However, it is crucial to consider factors such as your customer base, legal requirements, and operational capabilities before making the transition. Consulting with a professional or seeking guidance from digital receipt service providers can help facilitate a smooth transition.